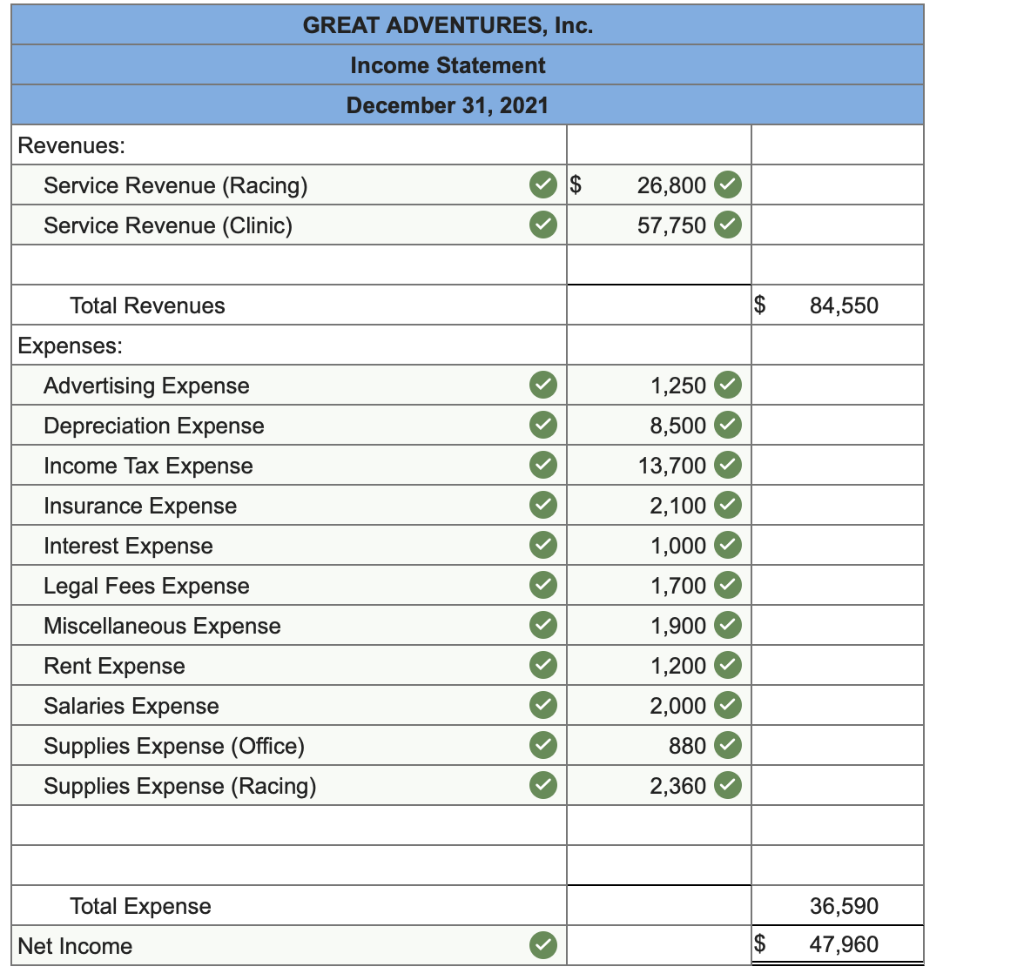

Now, the income summary account has a zero balance, whereas net income for the year ended appears as an increase (or credit) of $14,750. Now that we know the basics of closing entries, in theory, let’s go over the step-by-step process of the entire closing procedure through a practical business example. That’s exactly what we will be answering in this guide – along with the basics of properly creating closing entries for your small business accounting. The records are used to generate reports that tell an owner how much money flows in and out of their business. Below are the T accounts with the journal entries already posted. This example demonstrates how the COGS account tracks and reports direct expenses incurred for the sale of goods in a retail business.

Make a Preliminary Trial Balance

And so, the amounts in one accounting period should be closed so that they won’t get mixed with those in the next period. As you will see later, Income Summary is eventually closed to capital. OwnerRez is a short-term rental management software company offering QuickBooks integration, advanced automation features, and responsive customer support.

Closing the Books: Basics & 8 Steps Guide

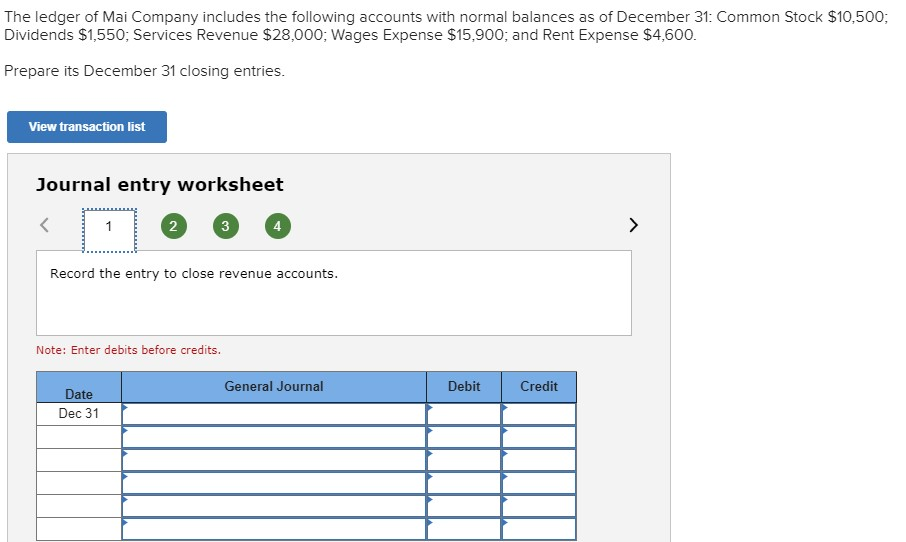

Closing entries take place at the end of an accounting cycle as a set of journal entries. The closing entries serve to transfer these temporary account balances to permanent entries on the company’s balance sheet. This resets the balance of the temporary accounts to zero, ready to begin the next accounting period. The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance. The trial balance shows the ending balances of all asset, liability and equity accounts remaining.

Comprehensive Guide to Inventory Accounting

Closing all temporary accounts to the retained earnings account is faster than using the income summary account method because it saves a step. There is no need to close temporary accounts to another temporary account (income summary account) in order to then close that again. Temporary accounts are income statement accounts that are used to track accounting activity during an accounting period. For example, the revenues account records the amount of revenues earned during an accounting period—not during the life of the company. We don’t want the 2015 revenue account to show 2014 revenue numbers. We see from the adjusted trial balance that our revenue account has a credit balance.

- Whether you need month- and year-end reports, owner statements, or need to optimize services like check-in/checkout and housekeeping, Escapia has got you covered.

- We have completed the first two columns and now we have the final column which represents the closing (or archive) process.

- The four closing entries are, generally speaking, revenue accounts to income summary, expense accounts to income summary, income summary to retained earnings, and dividend accounts to retained earnings.

- Lodgify ranks first as the best short-term rental management software for its powerful direct booking system and user-friendly website builder features.

- A closing entry is a journal entry that’s made at the end of the accounting period that a business elects to use.

How to Buy Land in 8 Steps: A Guide for Investors

In some cases, accounting software might automatically handle the transfer of balances to an income summary account, once the user closes the accounting period. The entries take place “behind the scenes,” often with no income summary account showing in the chart of accounts or other transaction records. Closing entries are journal entries made at the end of an accounting period, that transfer temporary account balances into a permanent account. “The books” are a business’s revenue, expense, and income summary reports.

Purpose of closing entries accounting

Plus, a variety of integrations for guest management, finances, home automation, marketing, and operations are available. Then, just pick the specific date and year you want the closing process to take place, and you’re done! In just a few clicks, the entire financial year closing is streamlined for you. The marketing techniques and skills that worked in a seller’s market are less effective today.

Debiting the expense account for its current balance reduces the balance to zero. The statement of retained earnings shows the period-endingretained earnings after the closing entries have been posted. Whenyou compare the retained earnings ledger (T-account) to thestatement of retained earnings, the figures must match. It isimportant to understand retained earnings is not closed out, it is only updated. RetainedEarnings is the only account that appears in the closing entriesthat does not close.

After most of the cycle is completed and financial statements are generated, there’s one last step in the process known as closing your books. These finalized reports show a business’s financial intro to forensic and investigative accounting chp 1 flashcards position over a certain accounting period—whether a month or an entire year. Journal entries are transferred to the general ledger when they’re posted to an account, such as accounts receivable.